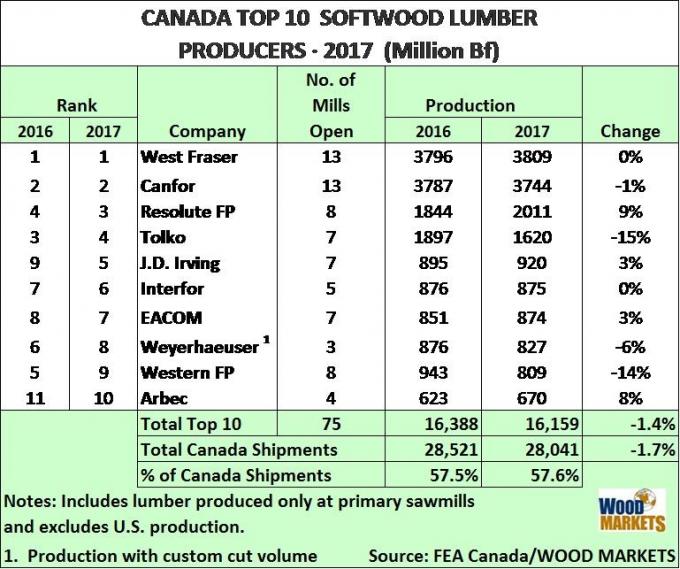

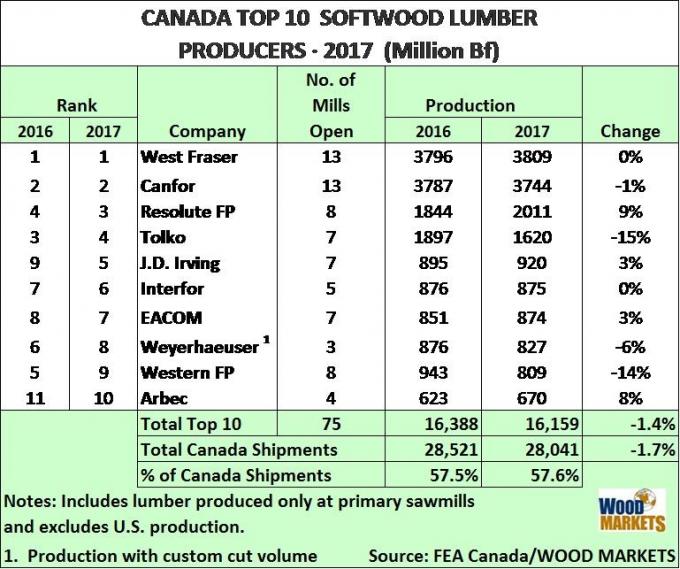

FEA Canada/Wood Markets’ 2017 annual survey of “Top 20” Canadian and U.S. lumber producers featured mixed production trends despite a runaway lumber market in the U.S. With few mill acquisitions, almost all of the production gains arose from improvements at existing mills. Of the top 40 companies, 8 in Canada and 6 in the U.S. recorded production declines — not the trend you’d expect during a time of near-record-high to record-high lumber prices. Total Canadian softwood lumber shipments declined by 1.7% to 28.0 billion bf while U.S. production increased by 3.7% to 33.9 billion bf.

The top 10 Canadian producers have seen their shipments grow at a slightly slower pace than the overall Canadian industry since 2014. In 2017, the softwood lumber shipments of the top 10 decreased marginally versus a larger decline in Canada as a whole (-1.4% for the top 10; -1.7% for Canada). The drop in Canadian shipments is a function of many factors, but the implementation of import duties to the U.S. in early 2017 was one that caused Canadian companies to re-evaluate their markets and mills.

Given the import duties, Canadian mill investments in the U.S. South are proving very strategic due to ample timber supply in the region and high sawmilling margins (the result of subdued timber prices due to oversupply). There was one notable U.S. acquisition in 2017:

West Fraser’s purchase of Gilman Lumber’s six sawmills. Currently, the collective U.S. mill count of West Fraser,

Canfor and

Interfor (45 mills) allows their sawmill operations to enjoy excellent diversification on both sides of the border. The top 5 Canadian producers in 2017 were ranked as follows: West Fraser, Canfor, Resolute (to #3 from #4), Tolko (from #3 to #4), and

J.D. Irving (of note, the latter’s Canadian production officially entered the top 5 for the first time).

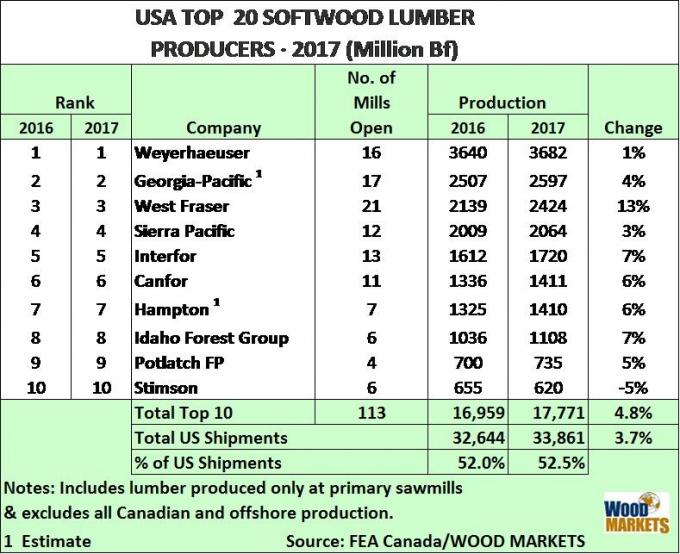

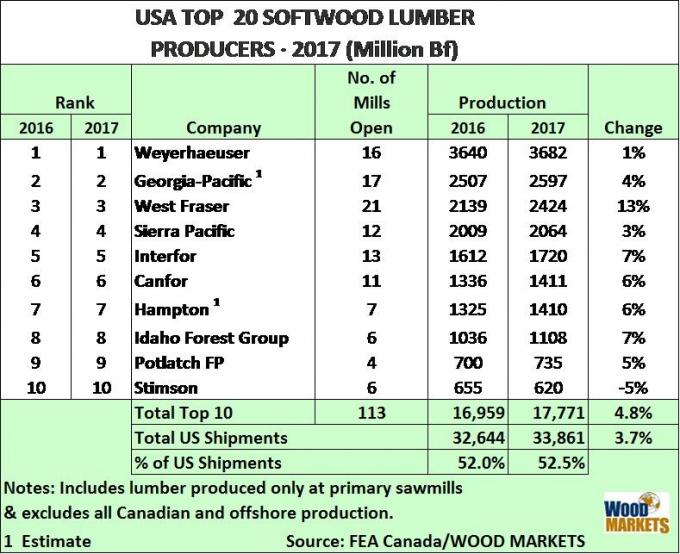

In the U.S., total lumber shipments of the top 10 companies rose from 16.96 billion bf to 17.77 billion bf (+4.8%). The top 10 U.S. companies increased their out put at a faster rate than the rest of the entire U.S. industry (3.7%). The growth in total U.S. shipments during 2017 was the strongest in the South — up 880 million bf (+5.1%) to 18.23 billion bf; the West was at 14.04 billion bf (+2.0%).

The top 10 firms produced 52.5% of all U.S. softwood lumber shipments in 2017 (versus 52.0% in 2016). With import duties on Canadian lumber, U.S. sawmills enjoyed higher prices and strong financial results. A flurry of new-mill and/or expansion announcements has occurred recently for the U.S. South, signalling an opportunity for more sawmill investment (some 4.5+ billion bf of announced capacities from 2018 through 2020) to take advantage of ample timber supplies and high lumber prices).

The top 5 U.S. producers in 2017 were ranked as follows (same as in 2016):

Weyerhaeuser, Georgia-Pacific, West Fraser, Sierra-Pacific, and Interfor. The top 5 U.S. firms produced 12.5 billion bf, representing 36.9% of all U.S. lumber shipments and up 4.9% from 2016. Three more U.S. companies maintained the one billion board foot level in 2017: Canfor, Hampton and

Idaho Forest Group (with updated production figures from our March 2017 WOOD Markets Monthly Report).

The wild card for 2018 is the extremely high level of U.S. lumber prices (inflated partly by the imposition of U.S. duties on Canadian lumber and also because of only small increases in North American lumber output). High prices attracted a 50% increase in offshore exports in 2017 and there are a dozen new sawmill projects planned for the U.S. South. As a result, U.S. lumber production will be expanding, but at some point, this new supply (and imports) will put negative pressure on prices. This will be discussed at length during FEA Canada/WOOD MARKETS’ Global Softwood Log & Lumber Conference, to be held in Vancouver May 9–10, 2018.