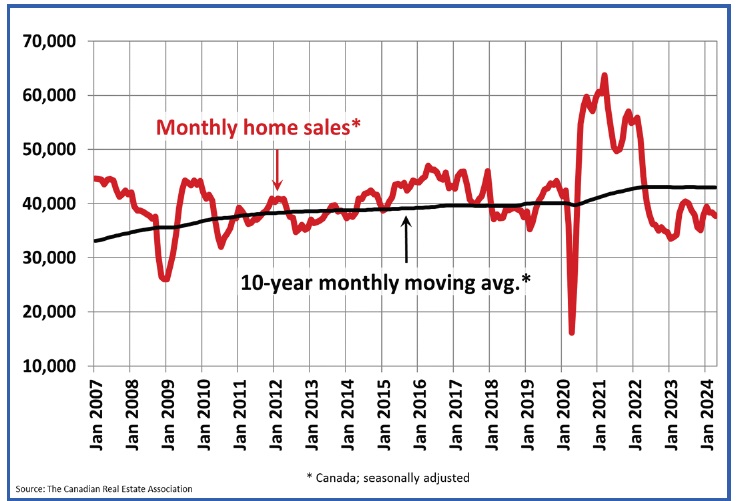

Canadian home sales dipped in April 2024 when compared to March, even as the number of properties available for sale rose to kick off the spring market, as the Canadian Real Estate Association (CREA) reported.

Home sales activity recorded over Canadian MLS Systems fell 1.7% between March and April 2024, coming in a little below the average of the last 10 years.

图像: The Canadian Real Estate Association

At the same time, the number of newly listed homes rose by 2.8% on a month-over-month basis. Slower sales amid more new listings resulted in a 6.5% jump in the overall number of properties on the market, reaching its highest level since just before the onset of the COVID-19 pandemic. It was also one of the largest month-over-month gains on record, second only to those seen during the sharp market slowdown of early 2022.

“April 2023 was characterized by a surge of buyers re-entering a market with new listings at 20-year lows, whereas this spring thus far has been the opposite, with a healthier number of properties to choose from but less enthusiasm on the demand side,” said Shaun Cathcart, CREA’s Senior Economist.

The actual (not seasonally adjusted) number of transactions came in 10.1% above April 2023; however, a significant part of that gain likely reflected the timing of the Easter long weekend.

With sales down and new listings up in April, the national sales-to-new listings ratio eased to 53.4%. The long-term average for the national sales-to-new listings ratio is 55%. A sales-to-new listings ratio between 45% and 65% is generally consistent with balanced housing market conditions, with readings above and below this range indicating sellers’ and buyers’ markets respectively.

There were 4.2 months of inventory on a national basis at the end of April 2024, up from 3.9 months at the end of March and the highest level since the onset of the pandemic. The long-term average is about five months of inventory.

“After a long hibernation, the spring market is now officially underway. The increase in listings is resulting in the most balanced market conditions we’ve seen at the national level since before the pandemic,” said James Mabey, newly appointed Chair of CREA’s 2024-2025 Board of Directors. “Mortgage rates are still high, and it remains difficult for a lot of people to break into the market but, for those who can, it’s the first spring market in some time where they can shop around, take their time and exercise some bargaining power. Given how much demand is out there, it’s hard to say how long it will last.”

The National Composite MLS Home Price Index (HPI) was unchanged from March to April, marking the third straight month of mostly stable prices.

Regionally, prices are generally sliding sideways across most of the country. The exceptions remain Calgary, Edmonton, and Saskatoon, where prices have steadily ticked higher since the beginning of last year.

The not seasonally adjusted National Composite MLS HPI dipped 0.9% on a year-over-year basis, the first decline since last July. This mostly reflects how prices took off last April, something that has not yet been repeated in 2024.

The actual (not seasonally adjusted) national average home price was $703,446 in April 2024, down 1.8% from April 2023.