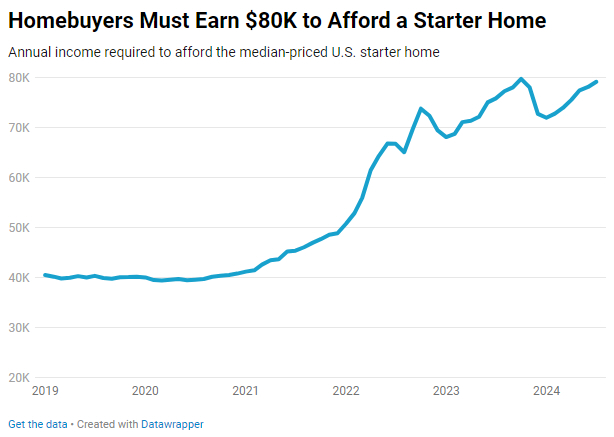

The typical U.S. starter home sold in July requires a homebuyer to earn $79,252 annually, a 4.4% increase from last year, just below the all-time high set in October. The monthly payment for such a home now stands at $1,981. These figures, highlighted in a new report from Redfin, reflect rising home prices and mortgage rates, which remain more than double pre-pandemic levels despite a slight decline from earlier peaks.

Home prices hit record highs, with the typical starter home selling for $250,000, up 4.2% year over year. This increase has strained affordability, pushing many lower-income Americans out of the market. The typical U.S. household income of $83,966 just meets the threshold needed for a starter home, but those earning 80% or less of the median income - $67,173 or less - fall short. Average hourly earnings grew 3.6% in July, but this has not kept pace with the rising income requirements to purchase a home. Bild: Redfin

Nationwide, the affordability of starter homes has decreased, with only 70% of such homes accessible to median-earning households, down from 73% last year. The demand for these homes has intensified, with pending sales rising 10% year over year in July, marking the highest level in nearly two years. Increased competition has led to creative offers, such as buyers offering non-monetary incentives to secure a home.

In Southern California, the gap between income and home prices is most pronounced. In Anaheim and Los Angeles, buyers need to earn more than twice the local median income to afford a starter home. For example, Anaheim’s median income is $122,192, but $251,302 is required to afford a starter home. This disparity is slightly smaller in other California cities but remains significant.

Conversely, starter homes in Rust Belt cities are more affordable. In Detroit, where the median income is $63,937, a household needs only $24,590 to purchase a starter home, making it the most affordable major metro. St. Louis and other cities in the region also offer relatively affordable starter homes.

Austin is the only major metro where the income needed to afford a starter home has declined, falling by 2.5% due to decreasing home prices. However, a local median income of $103,945 is still insufficient to afford a starter home in the Texas capital.

Despite challenges, there are some positive signs for prospective homebuyers. Listings of starter homes increased nearly 20% year over year in July, providing more options. Additionally, mortgage rates have been gradually decreasing, with the average rate at 6.46% as of August 22, down from earlier highs.

These shifts, combined with a slower growth rate in the income needed to afford a starter home, may signal a slight easing of the affordability crisis.