U.S. new single-family home sales posted a significant decline in April as housing demand deteriorated in the face of rising interest rates. After starting at 3.1% in December, the average 30-year fixed rate mortgage increased to 5.1% by the end of April, per Freddie Mac. Additionally, builders continue to grapple with supply-chain issues, limiting inventory in a market for which new construction is an increasingly important source of supply. All in, a significant number of prospective home buyers are being priced out of the market, according to the National Association of Home Builders (NAHB).

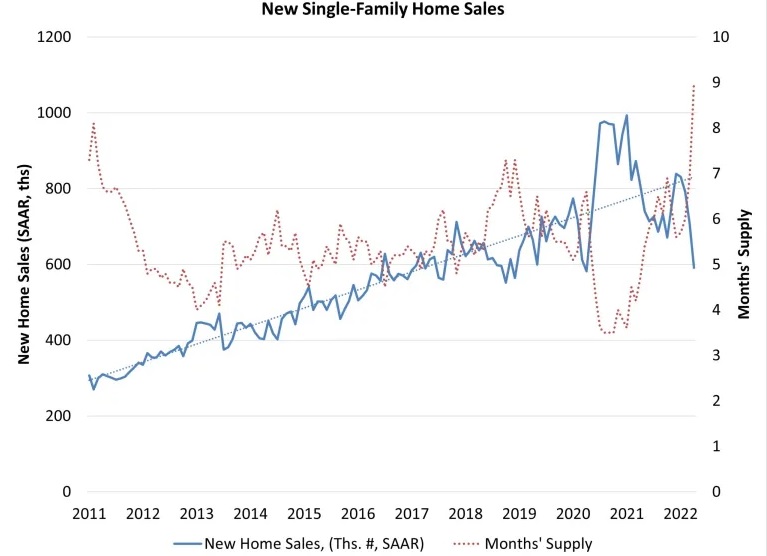

The U.S. Department of Housing and Urban Development and the U.S. Census Bureau estimate of sales of newly built, single-family homes in April fell to a 591,000 seasonally adjusted annual pace, a 16.6% decline from the March reading. The April reading is the lowest since April 2020. The current rate is 26.9% below the April 2021 estimate of 809,000. After an unsustainably strong period of new home sales from summer 2020 to early 2021, sales settled in to long-term trends in late 2021 and are now significantly weakening under tightening monetary policy. This is a clear recession warning for the overall economy for the quarters ahead.

Median sales price for new home sales in April increased to $450,600, a 19.7% year-over-year gain. Prices have increased as building material and other development costs have climbed. That process continues due to supply-chain issues and elevated inflation pressures. In another indicator that deteriorating affordability conditions are particularly hurting the entry-level market, a year ago, 25% of new home sales were priced below $300,000, while in April this share fell to just 10%.

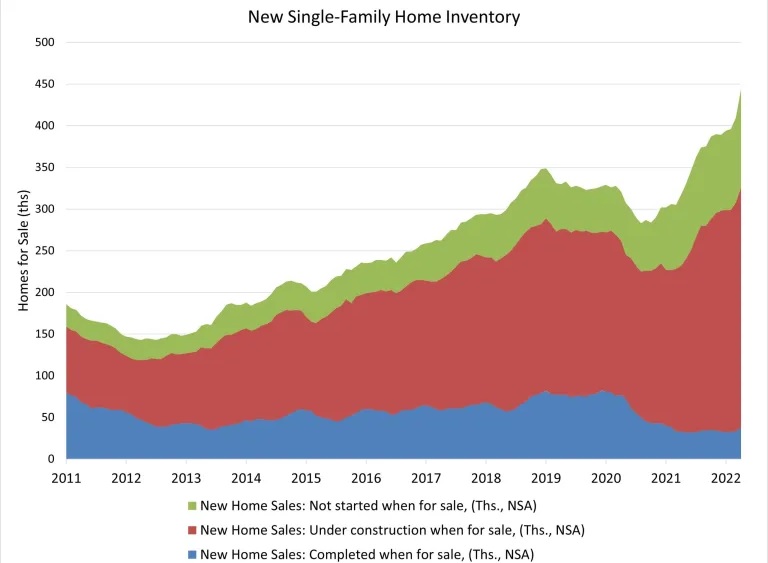

Sales-adjusted inventory levels spiked to an over-supply level at 9 months. This is well above a balanced market (4.5 months to 6.5 months) and points to construction declines ahead. The count of completed, ready-to-occupy new homes is 38,000 homes nationwide, up notably from 33,000 last month as demand slows. Total inventory (for all stages of construction) increased to 444,000, a 40% gain from April 2021.

Regionally in April, new home sales, on a year-to-date basis, are up 6.5% in the Northeast and down 16.8% in the Midwest, 19.3% in the South, and 0.6% in the West.