Domain Capital Group, LLC, a comprehensive private investment management services firm, announced its subsidiary, Domain Timber Advisors, has sold the remaining asset in the company’s Environmental Investments I Fund to a private investor. Acquired in 2017, the 2006 vintage fund originally raised $20 million and placed $19.3 million during its investment period.

The final sale included the 3,120-acre Longleaf Mitigation Bank in Nassau County, Fla. Protected by a perpetual conservation easement, it is one of Florida’s first recipient sites for the threatened gopher tortoise. Restoration included timber stand improvement, re-establishment of a natural wetland regime, and the planting of more than 100,000 native tree seedlings (mostly longleaf pines).

“We are excited to close our first environmental investment fund and experience continued demand and growth of this asset class,” said Joe Sanderson, managing director of natural resources at Domain Timber Advisors, LLC, an SEC-registered investment adviser. “Our portfolio positions us as an established investment manager in the environmental mitigation market – in terms of assets under management and number of projects across the country. We focus our investment strategy on real property or other natural resources with unrealized ecological value due to hydrology, biodiversity, habitats, location, restoration potential and many other characteristics.”

Servicing the St. Mary’s and Nassau River watersheds, the Longleaf Mitigation Bank was permitted by the St. Johns River Water Management District and U.S. Army Corps of Engineers. It supplied approximately 268 state forested freshwater wetland mitigation credits, per the Uniform Mitigation Assessment Method. The bank also provided approximately 1,027 federal forested freshwater credits, in accordance to the Wetland Rapid Assessment Procedure rating index.

Since its development, the site totaled 218 credit sale transactions worth more than $27 million in gross credit sale revenue. It provided offset impacts for residential and mixed-used developments, municipal infrastructure improvements, state and federal transportation construction, and clean energy projects. The fund expects to complete all accounting and administrative requirements, return all remaining cash balances and distribute final investment management reports by the end of third quarter 2020.

Atlanta-based Domain Capital Group, LLC provides comprehensive private investment management services, through its registered investment advisor subsidiaries, to institutions, public and private pensions, corporations, foundations, endowments, and high-net-worth individuals. Domain Capital Group’s investment professionals are experienced across a diverse range of asset classes and investment strategies, including real estate, natural resources, media, entertainment, technology, and credit and other financial services. As of December 31, 2019, Domain Capital Group managed approximately $6.1 billion in total assets – comprised of securities portfolios and real estate, among Domain Capital Advisors, LLC and Domain Timber Advisors, LLC.

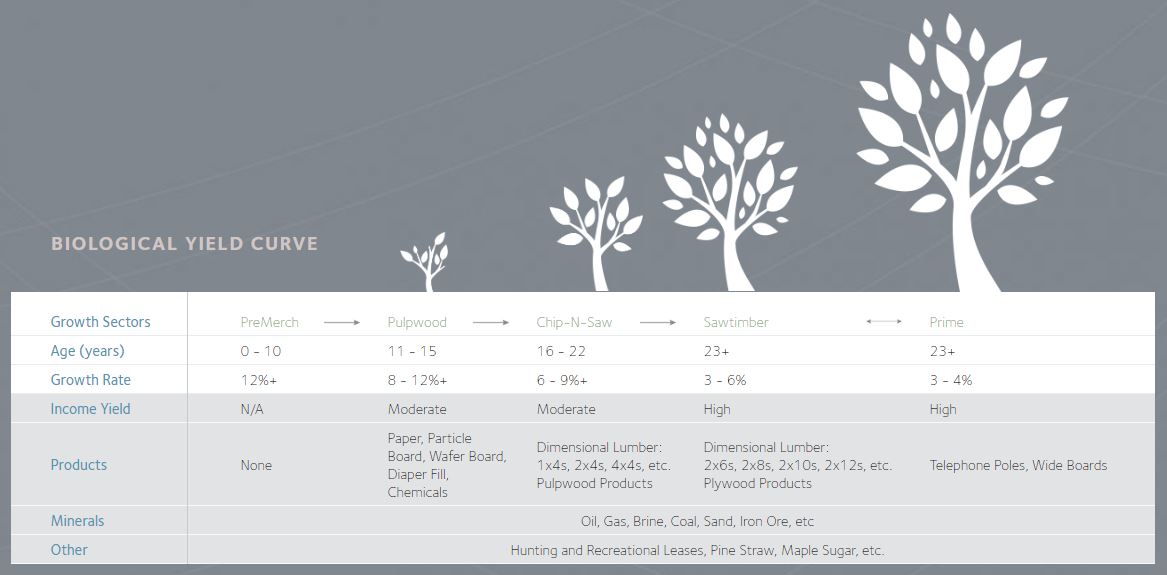

Biological Growth Element Reduces Risk

Biological tree growth, which is unaffected by the economy and invariable positive, is a unique feature that sets timberland apart from other asset classes.

Biological growth has a compounding effect in both volume and value. First, biological growth provides increasing total volume of wood. Trees, on average, can be expected to grow in volume approximately 2-8% per year, depending on location. Secondly, as diameter increases, the trees become more valuable, with large diameter trees being more valuable than smaller ones.

Image: Biological Yield Curve / Domain Timber Advisors