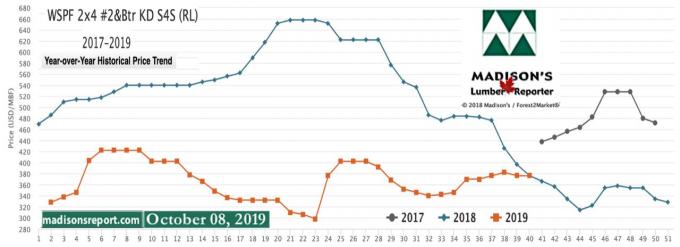

After soaring to record-level highs during the 2018 US home building season, softwood lumber prices slid inexorably downward well into this summer. The stringent and painful sawmill closures and curtailments during this year have done well to keep a healthy supply-demand balance. While customers are somewhat reluctant, ongoing weekly purchases are allowing Canadian and US sawmills to prop up prices. As US Thanksgiving approaches — the usual slow-down for US housing construction — demand will lessen into year-end.

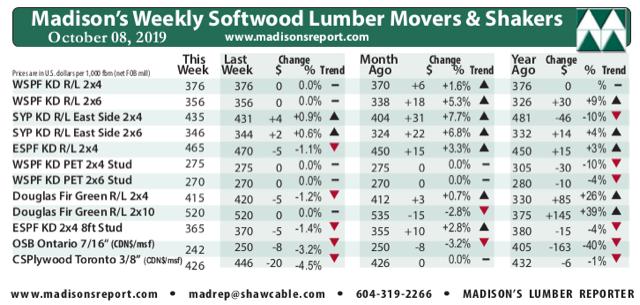

Benchmark item Western Spruce-Pine-Fir KD 2x4 #2&Btr stayed flat last week, at US$376 mfbm. Last week's price is +$6, or +1.6%, more than it was one month ago. Compared to one year ago, this price is unchanged. Canadian producers of WSPF lumber noted that buyers were pretty quiet last week. Sawmills turned their attention to receiving incoming log loads and fulfilling their own previously-made sales. Sales volumes were adequate for most of last week, but were “nothing to write home about”. Log inventories at western Canadian sawmills were lower than optimal. While construction activity was apparently hale and hearty in many US regions, buyers in the mountain states were winding down their inventories in advance of approaching inclement weather.

Compared to historical trend, last week's WSPF 2x4 #2&Btr price is up +$14, or +3.4%, relative to the 1-year rolling average price of US$362 mfbm, and is down -$70, or -16%, relative to the 2-year rolling average price of US$446 mfbm. Traders of WSPF lumber in the US noted that sales activity took another small step back last week. Lower transaction volumes appeared to be the norm among sawmills.

Operators of Kiln Dried Douglas-fir lumber described their market as flat to toppish last week. Buyers were apparently in a tricky situation of their own making; wherein previously-made sales had to be fulfilled but price levels at both primary and secondary suppliers were not to their liking. Lumber users of all types have been carrying so little inventory in recent weeks and months, they were in a position of having to pay unpalatable prices to keep their own charges happy, even if at a loss. For their part, KD Douglas fir producers maintained one or two week order files at their sawmills, depending on the facility and item.

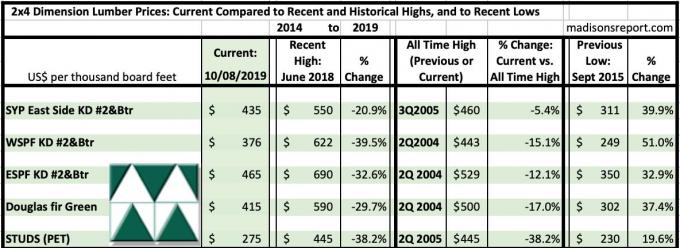

The below table is a comparison of recent highs, in June 2018, and current October 2019 benchmark dimension softwood lumber 2x4 prices compared to historical highs of 2004/05 and compared to recent lows of Sept 2015: