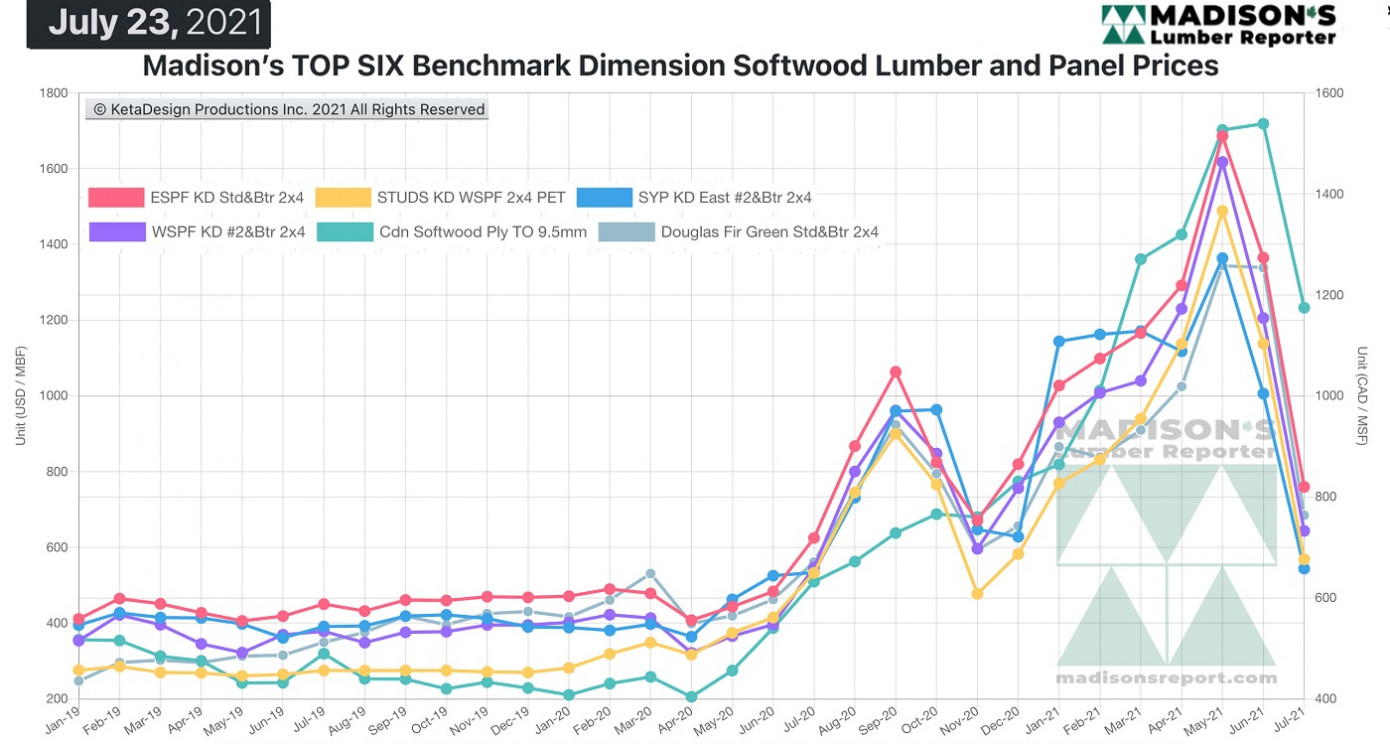

The latest construction framing dimension softwood lumber and panel price movement downward in North America has been enough to motivate previously reluctant customers to start making purchases again. Other circumstances, like wildfires and extreme heat in the usual timber supply areas, are adding uncertainty to how the rest of 2021 summer is going to go, according to Madison’s Lumber Reporter.

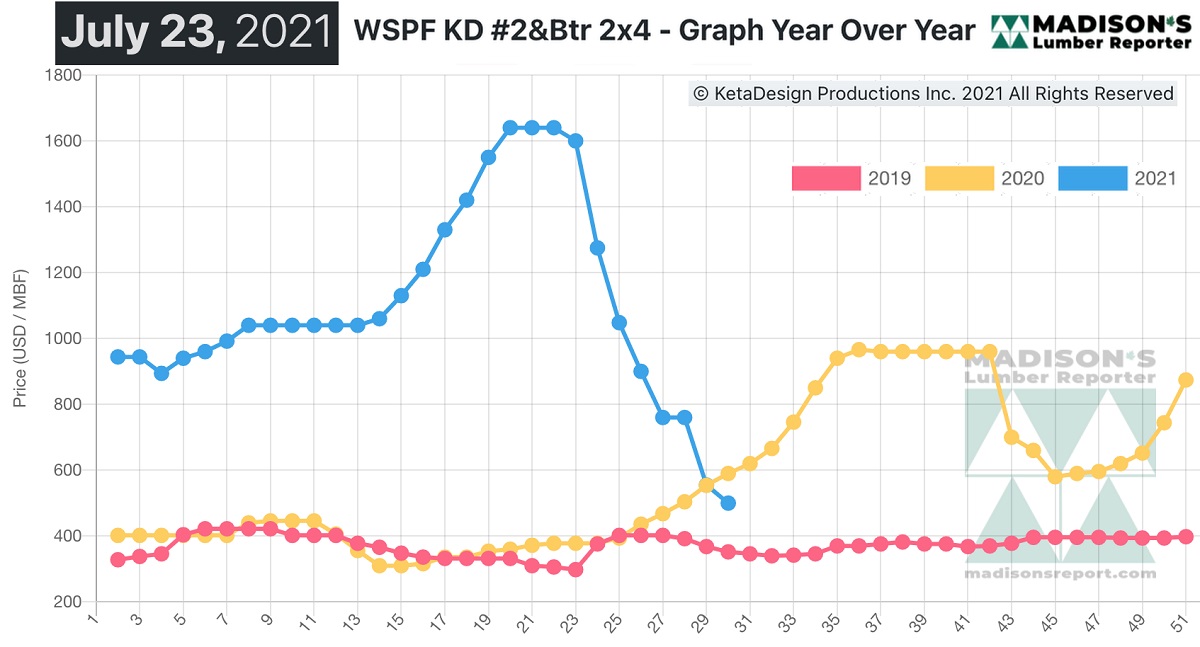

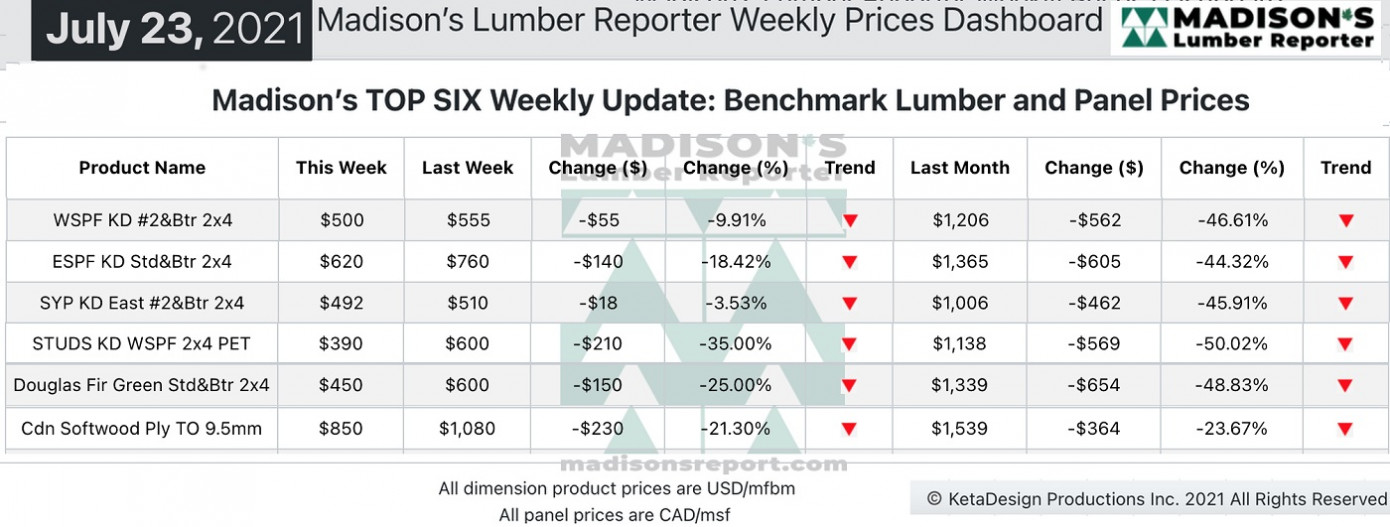

After touching exactly the price of one year ago, in the week ending July 23, 2021 the wholesaler price of benchmark softwood lumber commodity item Western S-P-F KD 2x4 #2&Btr fell yet more. That week’s price of US$500 mfbm is down by -$55, or (-10%), from the previous week when it was $555, and is down by -$706, or (-59%), from one month ago when it was $1,206.

Encouraging US single-family construction activity kept momentum going for lumber sales, even as sales volumes were dropping. It seemed like the market could turn on a dime. The appetite for wood remains strong, it’s just that customers have collectively balked at those unprecedented high prices of two months ago.

Demand for Western S-P-F in the United States stumbled out of the gate before gaining strength through the rest of that week. Production and supply dominated the conversation. Curtailment announcements in Canada caused secondary suppliers to pull the trigger, and downstream buyers followed suit to restock their depleted inventories. Buyers were mostly focussed on standard grade dimension, as demand for studs and low grade remained weak.

Canadian purveyors of Western S-P-F commodities spent another week trying to find a tradable bottom. Prices remained variable by wide margins as primary and secondary suppliers competed for limited demand. Sawmills continued to receive deep counter offers from buyers but were less receptive than in recent weeks, even as volumes of prompt material piled up. Producers had enough logs to last between two weeks and two months, depending on the mill. Wildfire activity and danger in Western Canada was horrific again.