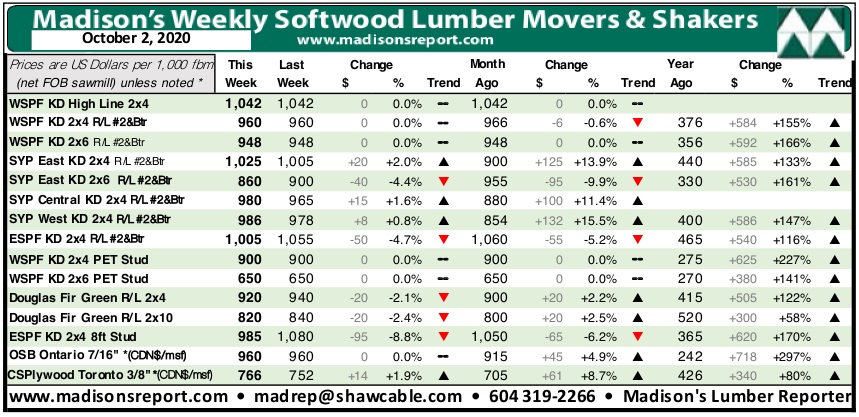

Last week most sawmills reported order files of three weeks or longer, which is quite strong for this season. Deliveries were terribly behind, making customers nervous that about their wood arriving in time for construction needs. Demand was truly non-stop, so there is no reason for lumber producers to lower prices. The good news is that all sawmills well stocked with logs. Eastern S-P-F R/L and Western S-P-F straight-lengths prices corrected down last week by a noteworthy amount, according to Madison’s Lumber Reporter.

However the week before OSB & Plywood prices popped up significantly, providing no immediate clarity on the future direction of the North America construction framing dimension softwood lumber market. US housing data continues extremely strong for the time of year. These storms and wildfires are scaring people.

Sales volumes and inquiry in the US Western S-P-F market dwindled again last week as buyers noted some sawmill asking prices corrected down. Order files at sawmills varied from three to five weeks out depending on the source, and transportation continued to throw a spanner into every shipment. Complaints about rail service were more common by the day and players knew that this will only worsen as the mercury drops.

Demand was similar to the previous week according to Western S-P-F producers in Canada. Sales activity was quiet as players digested wood and sawmills focussed on getting product out to market in the face of ongoing rail troubles. While price corrections were mostly confined to straight-lengths, producers were listening more intently to counter offers on all items than they have in months. Order files were in the four- to five-week range, which sawmills maintained would be shorter if shipments were smoother and if they were getting more than 60% car supply.

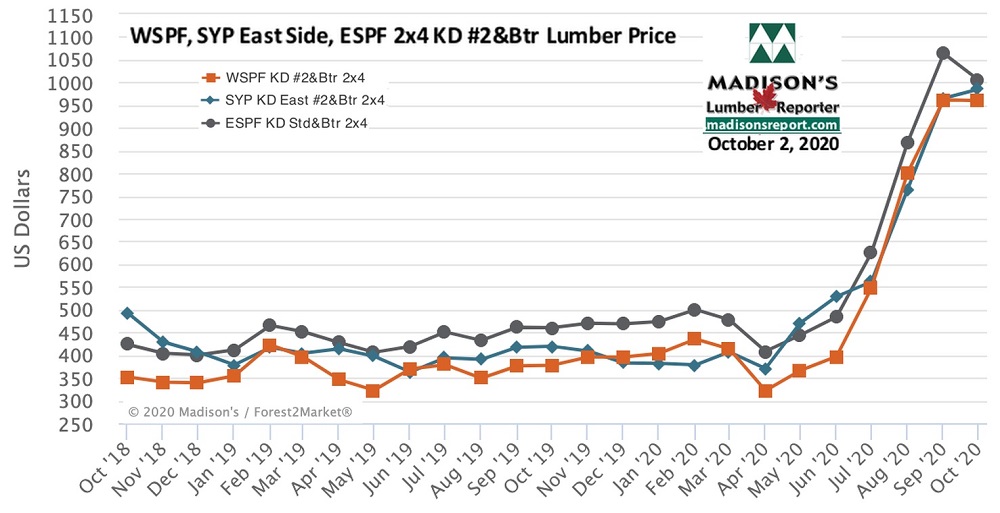

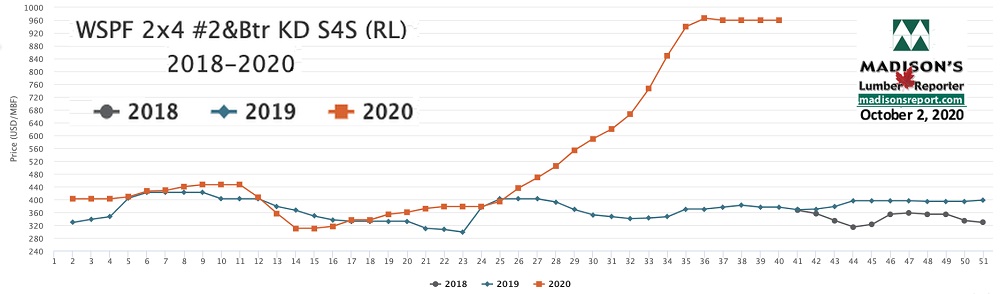

For the week ending October 2, 2020 the price of benchmark softwood lumber commodity item Western S-P-F KD 2x4 #2&Btr remained flat once again, at US$960 mfbm, said Madison’s Lumber Reporter. This price is now -$6, or -1%, less than it was one month ago. Compared to one year ago, this price is up a stunning +$584, or +155%.

Compared to one-year-ago, last week's Western S-P-F KD 2x4 #2&Btr price was +$469, or +96%, higher than the 1-year rolling average price of US$491 mfbm and was up +$533, or +125%, compared to the 2-year rolling average price of US$427 mfbm.

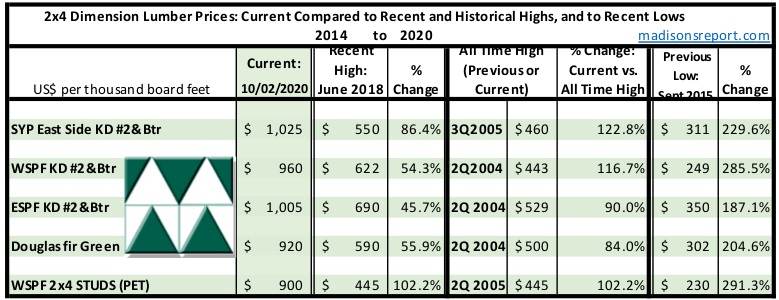

The below table is a comparison of recent highs, in June 2018, and current October 2020 benchmark dimension Softwood Lumber 2x4 prices compared to historical highs of 2004/05 and compared to recent lows of September 2015: