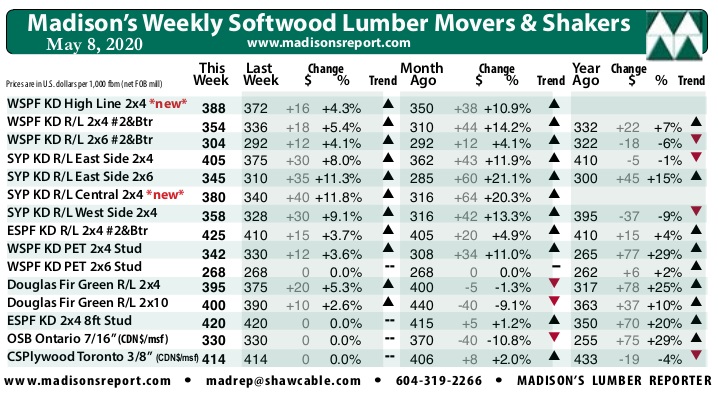

North American construction framing dimension softwood lumber prices last week improved greatly over those one-month-ago, even surpassing what prices were in May 2019, according to Madison’s Lumber Reporter.

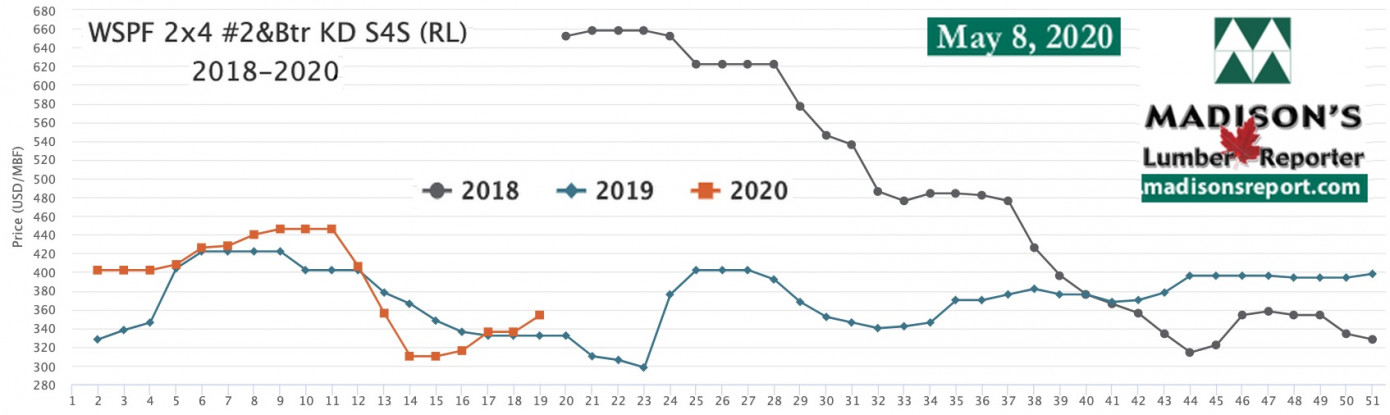

The wholesaler price of benchmark softwood lumber commodity item Western Spruce-Pine-Fir KD 2x4 #2&Btr (RL) last week was US$354 mfbm (net FOB sawmill), catapulting up +$22, or almost +7%, compared to the same week in 2019.

Suppliers of Western SPF commodities in the United States were cautiously optimistic to start the month of May. Both primary and secondary suppliers reported a positive tone to the market. Producers extended the bulk of their sawmill order files into late-May. Sales activity of most commodities was solid, with 2x6 #2&Btr R/L the only item lagging behind slightly in demand early in the week.

Rebounding completely from the lows of April, for the week ending May 8, 2020, Western SPF 2x4 price was up +$26, or +8.4%, from one month ago when it was US$310 mfbm. Compared to one year ago, this price is up +$22, or almost +7%.

In Eastern Canada, sales activity took a couple days to get going again last week, as producers were reluctant to sell far out on the limited production volumes which became available. Due to throttled supply, finding exact tallies among depleted sawmill inventories to cover immediate needs was difficult. Buyers were forced to search around for incomplete orders to furnish their own scant inventories. For Eastern stocking wholesalers on the shores of New Jersey, the beginning of May didn’t look much different than the gloom of April. As sawmill prices advanced, vendors did their best to turn a profit on the limited business they could find, but most ended up losing money on virtually every transaction.

Continuing to make gains, last week's Western S-P-F 2x4 price was down -$21, or almost -6%, relative to the 1-year rolling average price of US$375 mfbm and was down -$56, or -14% relative to the 2-year rolling average price of US$410 mfbm.

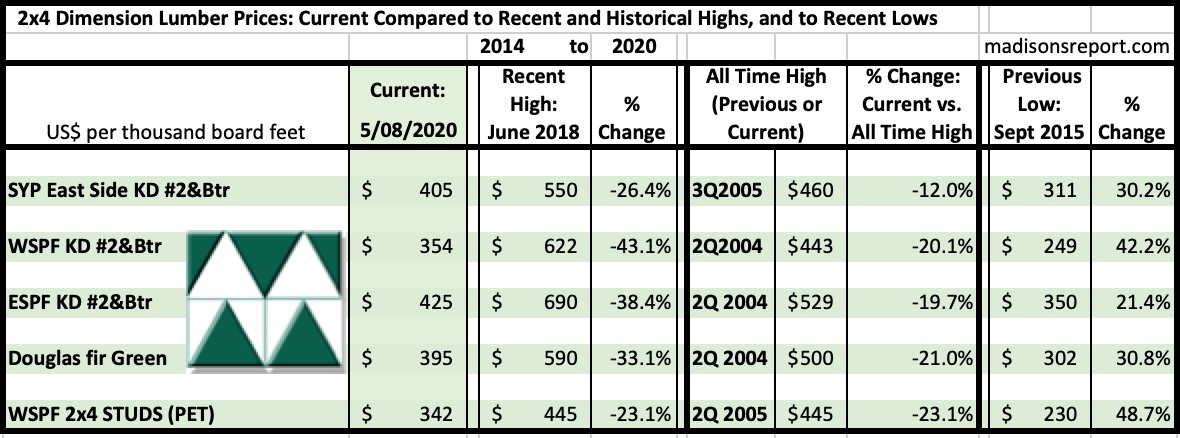

The below table is a comparison of recent highs, in June 2018, and current May 2020 benchmark dimension softwood lumber 2x4 prices compared to historical highs of 2004/05 and compared to recent lows of Sept 2015: