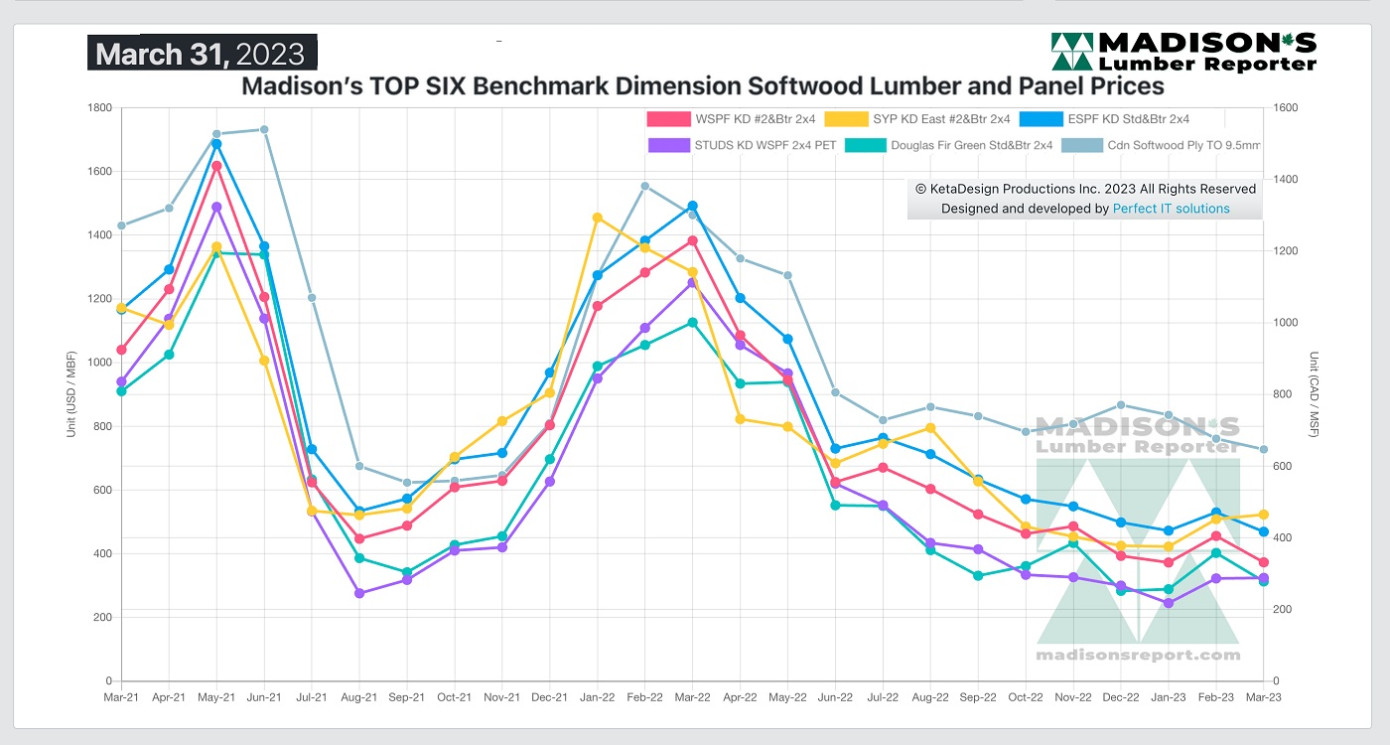

Lumber prices dropped yet again at the end of March, as demand remained soft and customers skeptical. While sawmills were able to book order files out two weeks or longer, most buying remained just-in-time. Almost no one was stocking inventory, which is a bit odd given the time of year. Usually by the end of March the weather is quite improved and all eyes look toward the oncoming spring building season. This year, the seemingly relentless rounds of storms and snow across the continent has delayed that burst of spring lumber buying. Add to that a sense of economic uncertainty, specifically in regard to home building and housing construction, and the result is low volumes of lumber sales.

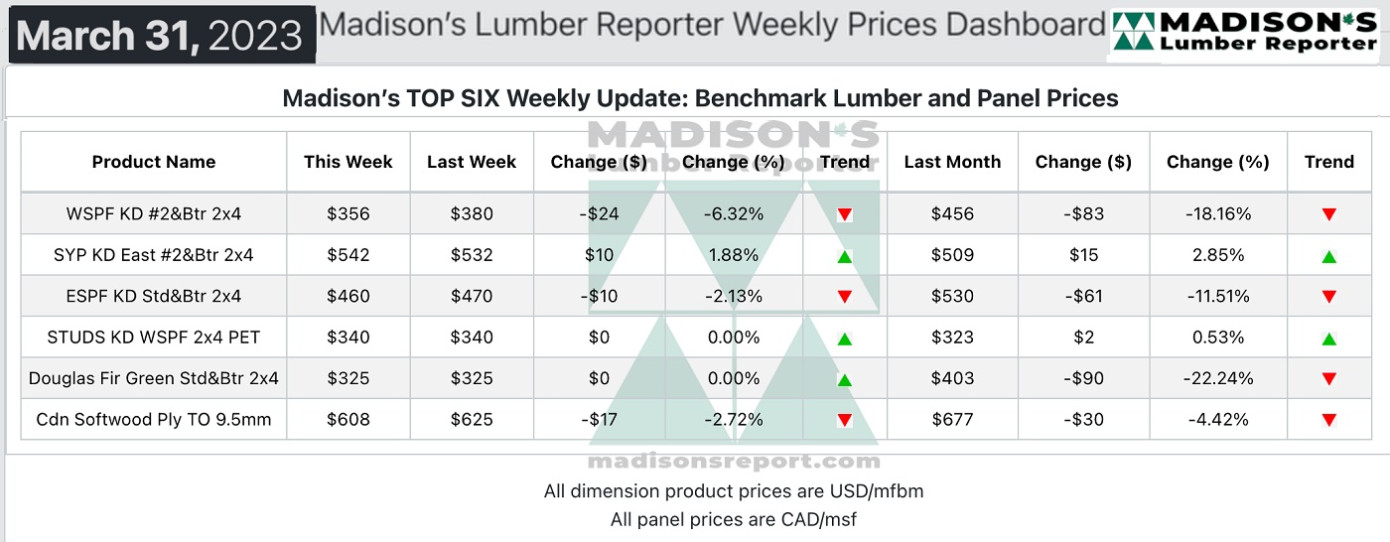

In the week ending March 31, 2023, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) was US$356 mfbm, which is down by -$24 or -6%, from the previous week when it was US$380 mfbm, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.This is down by -$17, or -5%, from one month ago when it was $373.

US sawmills with extended production schedules held their prices flat, while those in weaker positions made it known they were open to all but the most egregious counteroffers.

Despite pockets of promising sales in both lumber and panels this week, the tone remained frustrating and uninspired.

Sales volumes of Western S-P-F in the US hung in there, but suppliers were frustrated with the lack of improvement as March came to a close. The vaunted spring building rush was held back by enduring cold weather and a benighted economic outlook. Faltering lumber futures also caused to buyers to hesitate with their purchase decisions. Steady demand for 2x4 and 2x6 contrasted starkly with weak inquiry into wides.

While customers stuck to short-covering, Western Canadian lumber suppliers waited with bated breath for the dam to burst on spring buying. Inquiry and takeaway of 2x4 and 2x6 R/L #2&Btr was better than of wides, which experienced weaker demand and some significant downward price pressure. Wholesalers and distributers reported steady sales volumes thanks to growing demand from several key construction markets where spring weather has arrived. Sawmill order files were into the week of April 10th.

Eastern Canadian lumber suppliers were busy as a revolving door of buyers kept orders flowing. That steady downstream activity boosted the confidence of wholesalers and distributers, who consistently replenished their inventories with a variety of items. For their part, producers kept asking prices flat or slightly down from the previous week’s levels. The ample availability shown by both primary and secondary suppliers early in the week dried up noticeably by Wednesday as buyers appeared to lose the upper hand of shopping around at their leisure. Thanks to that strong takeaway in the early going, sawmill order files now stretched into the second or third week of April.

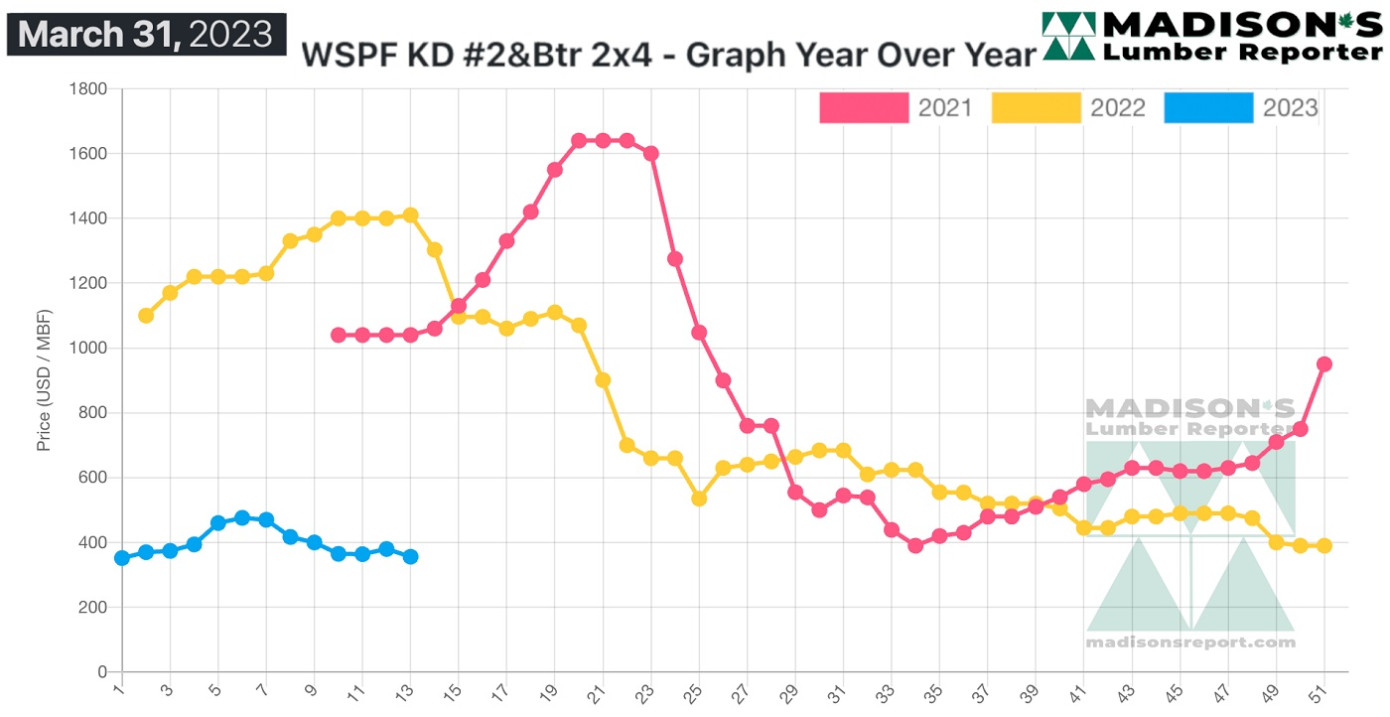

Compared to the same week last year, when it was US$1,410 mfbm, the price of Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) for the week ending March 31, 2023 this price was down by -$1,054, or -75%. Compared to two years ago when it was $1,040, that week’s price is down by -$684, or -66%.