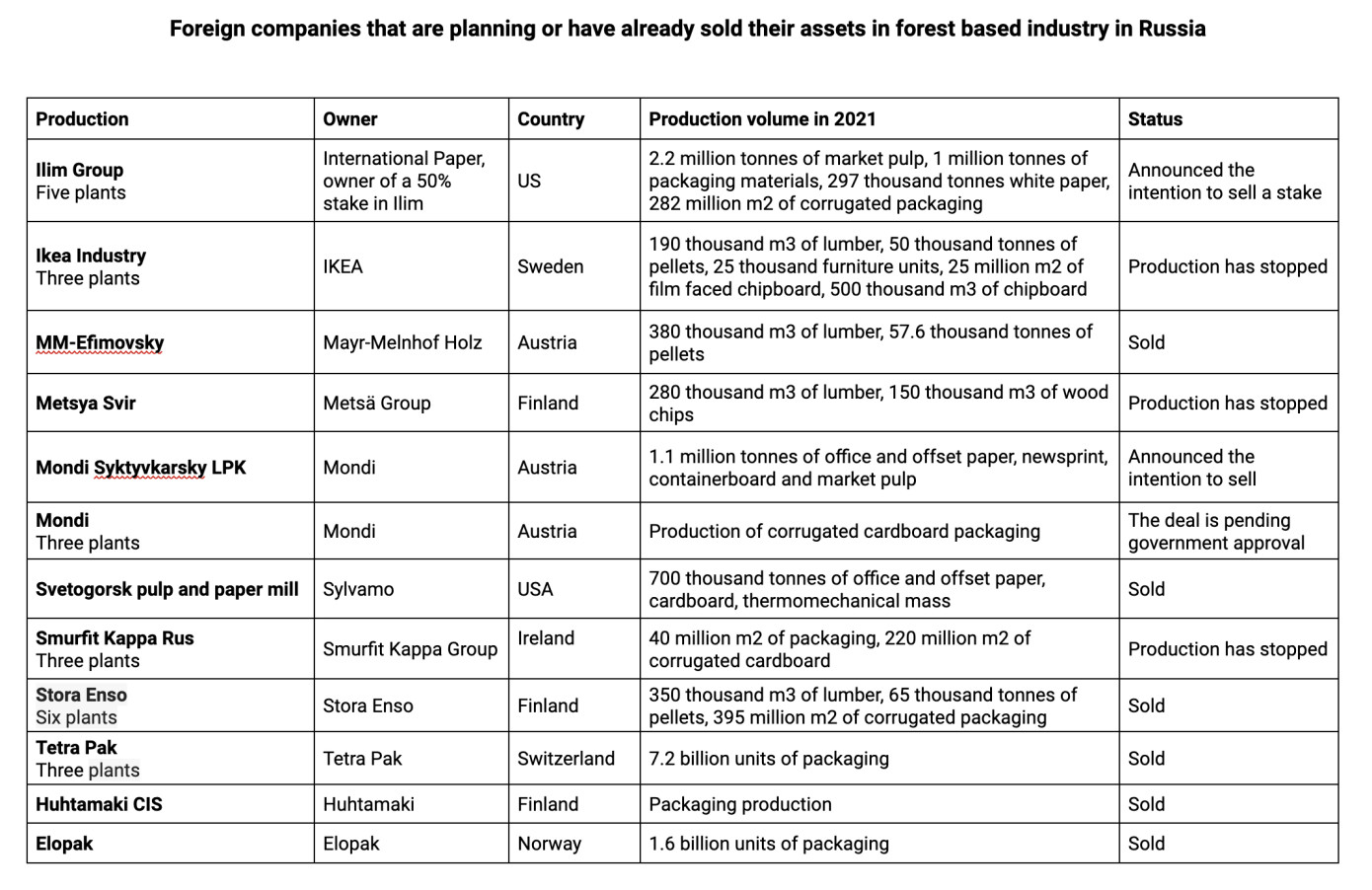

The withdrawal of foreign companies from Russia in 2022 may lead to a shortage of certain timber products, which will gradually be covered by Russian-made products. However, the quality of products will be lower due to the cessation of supplies of Western consumables and components.

Western companies began to announce the possible sale of their Russian assets, immediately opposing Russia's invasion of Ukraine. The exodus from Russia was associated not only with political, but also with economic reasons. As a result of the sanctions, Russian factories that supplied products to Western markets found themselves without sales. And increased freight rates due to the cessation of work with Russian cargo by the largest container companies have sharply increased the cost of deliveries to Asia, the main export market for Russian sawmills and pulp companies.

Among the exiting woodworking companies, the Swedish IKEA is the leader in terms of production volume. The company owns three factories in Russia in the Leningrad, Kirov and Novgorod regions with a total capacity of 500 thousand m3 of polished chipboard, 25 million m2 of chipboard, 190 thousand m3 of lumber, 50 thousand tonnes of pellets and 25 thousand m3 of furniture units per year. The deal to sell the factories may be closed by the end of the first quarter of 2023, but the company has not yet announced a buyer.

The Finnish Metsä Group suspended the operation of the Metsä Svir sawmill with a capacity of 280 thousand m3 of sawn timber and 150 thousand m3 of chips back in the summer. Currently, the plant is not operating, but the company has not publicly announced anything about the sale of the asset. At the same time, according to Lesprom Network, Metsä Group's logging company Metsä Forest Podporozhye has resumed operations, albeit to a lesser extent.

Stora Enso sold the Setnovo and Setles plants with a total capacity of 350 thousand m3 of sawn timber and 65 thousand tonnes of pellets to Russian management. At the beginning of 2023, the Austrian Mayr-Melnhof Holz sold the MM-Efimovsky plant in the Leningrad Region with a capacity of 380 thousand m3 of sawn timber and 58 thousand tonnes of pellets to the Russian company Aspek-Les.

At the same time, the Austrian Kronospan, which owns five plants in the country with a capacity of more than 1 million m3 of OSB panels, 2 million chipboards and 50 thousand m3 of film faced chipboard, continues to work in Russia without changes. The Austrian company Egger did not stop the operation of its two Russian factories with a capacity of 873 thousand m3 of chipboard, 350 thousand m3 of MDF, 15 million m2 of chipboard, 15 million m2 of laminate and 55 million m2 of impregnated paper. The Turkish Kastamonu plant in the Republic of Tatarstan with a capacity of 1 million m3 of MDF and 35 million m2 of laminate is still operating.

The Swiss Krono Group also continues to operate on the Russian market with a plant in the Kostroma region with a capacity of 500 thousand m3 of MDF and 700 thousand m3 of chipboard. Iida Group continues to own a 75% stake in the Far East RFP Group, which has a 2 million m3 of logging capacity, 240 thousand m3 of lumber, 240 thousand m3 of veneer and 10 thousand tonnes of wood pellets per year. The plant belonging to the German company PERI in Noginsk near Moscow, with a capacity of more than 2 million linear meters of formwork beams, is operating normally. The Austrian Hasslacher Norica Timber continues to operate in Russia, which owns the Hasslacherles plant with a capacity of 49.2 thousand m3 of lumber, more than 8 thousand m3 of veneer logs, 89 thousand m3 of wood chips and 15 thousand tonnes of pellets.

In the pulp and paper industry last year, large Western packaging manufacturers left the Russian market. Tetra Pak handed over three of its Russian plants with a total capacity of 7 billion units of packaging to local management, citing the impossibility of supplying production components due to sanctions. Stora Enso has sold four plants with a capacity of 395 million m3 of corrugated packaging to Novopak, which is owned by the management of these plants. The Norwegian Elopak sold the plant in Russia with an annual capacity of 1.6 billion units of packaging also to local management. Amcor has announced the sale of three of its plants in Russia. Finnish Huhtamaki sold its business in Russia for Euro 151 million to Espetina. The Irish Smurfit Kappa Group announced its withdrawal from the Russian market and stopped the operation of its three factories with a capacity of 220 million m2 of corrugated board and 40 million m2 of packaging. Sylvamo has sold Svetogorsk pulp and paper mill with a capacity of 700 thousand tonnes to Pulp Invest. The Austrian Mondi sold its packaging business in Russia (not including Mondi SLPK) to the Gotek Group for 1.6 billion rubles.

Image: Lesprom Network

It is more difficult for foreign companies to sell assets in Russia, the larger they are. And even if a buyer is found, the deal must be approved by the Government Commission for Control over Foreign Investments in the Russian Federation. According to the requirement of the Ministry of Finance dated December 22, 2022, the sale must be at a discount of at least 50%. Therefore, the sale of a major asset in the forest based industry may be difficult. According to the Financial Times, due to the need to obtain government approval for the sale, many foreign banks were unable to sell their Russian assets and were forced to continue operating. It could also hamper deals that were negotiated before the government's new demand, as already-agreed sale prices would fall by half as the authorities exercise more influence over deals. The FT notes that under these conditions, Russian assets of Western banks can be acquired by companies close to the Russian government.

In the forest based industry, the Austrian Mondi has already faced a new requirement, trying to sell its Mondi SLPK plant with a capacity of 1.1 million tonnes. The company was going to sell it to Viktor Kharitonin's Augment Investments Limited for Euro 1.5 billion. However, the Russian government did not approve of this deal, considering the price too high.

Another major asset announced for sale is a 50% stake owned by International Paper in the Ilim Group. The company announced its intention to leave Russia last spring. However, a new government requirement could make the sale too unprofitable. The Ilim Group is the largest company of the forest based industry in Russia with a revenue of 180.3 billion rubles ($2.5 billion) in 2021.

According to Pavel Bilibin, a partner at Strategy Partners, due to the exit of foreign companies in the short term, Russia may experience a shortage of certain goods due to the destruction of distribution and sales chains. “In the long term, there will be import substitution of departed manufacturers and filling the vacated niches with other companies, which in the future will lead not only to replacing the share of departed players, but also to crowding out some of the currently imported positions,” he says.

Alexander Konyukhov, deputy CEO for production of SevLesPil sawmill, agrees with this forecast. “Perhaps the production volume will be a little smaller, perhaps the products will be somewhat inferior in quality,” he adds. The Russian forest based industry faces challenges in access to technology and equipment, lack of logistics routes, and difficulties in redirecting goods to new export markets.