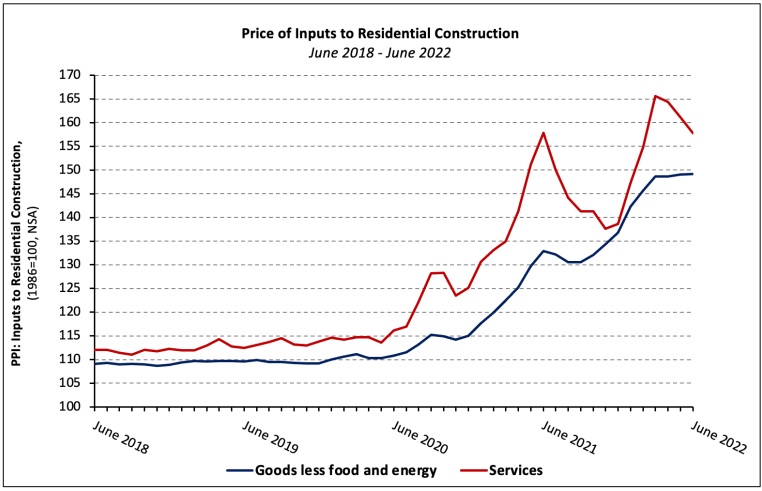

The prices of U.S. goods used in residential construction climbed 1.5% in June (not seasonally adjusted) even as softwood lumber prices fell 23%, according to the latest Producer Price Index (PPI) report. Prices have surged 41.7% since January 2020. Building materials (i.e., goods inputs to residential construction, less energy) prices have increased 4.8%, year-to-date, and are 12.2% higher than they were in June 2021, according to the National Association of Home Builders (NAHB).

The price index of services inputs to residential construction was driven 2.1% lower in June after a 2.0% decline in May (revised) by decreases in the building materials retail and wholesale trade indices. The services PPI is 0.1% lower than it was 12 months prior and 37.6% higher than its pre-pandemic level.

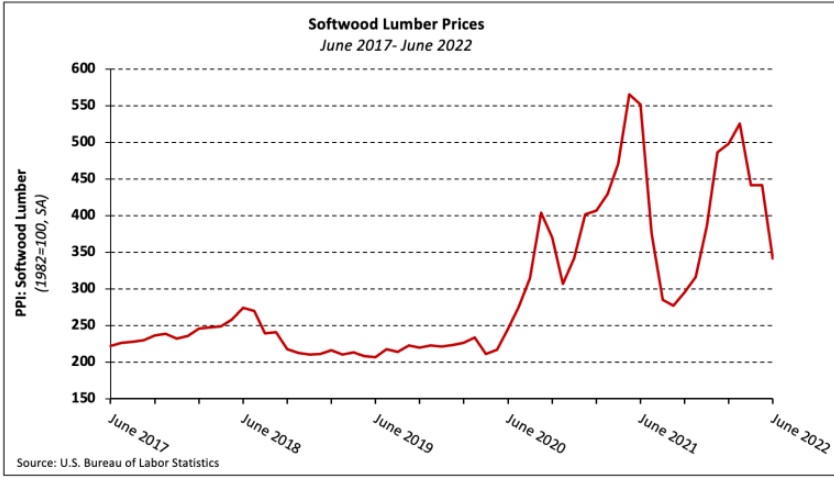

Softwood Lumber

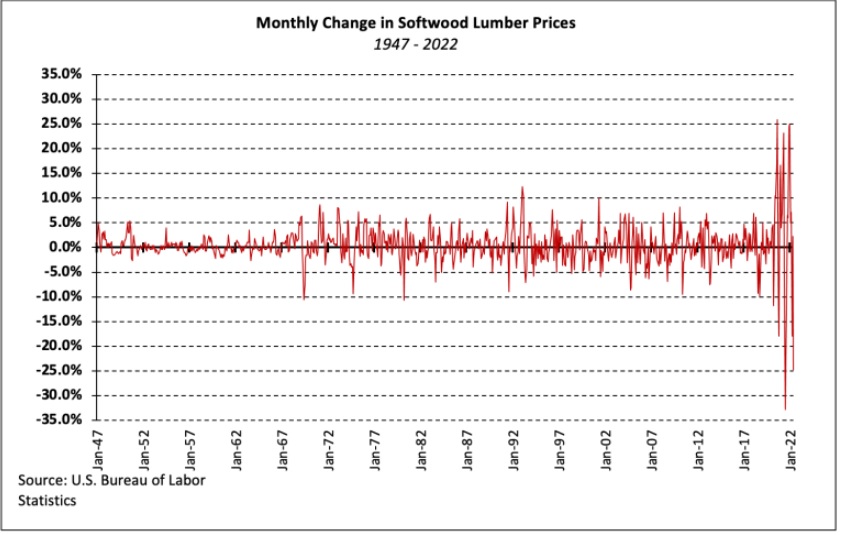

The PPI for softwood lumber (seasonally adjusted) fell sharply (-22.6%) in June, its second such decline in three months. Prices have fallen 35.0% since March 2022, although the extent to which the decrease has reached home builders and remodelers is unclear.

Since early 2020, softwood lumber prices have been extraordinarily volatile. The average monthly change in the PPI for softwood lumber has been 2.6% since January 2020, nearly nine times the average change (+0.3%) from 1947 to 2020. The volatility of softwood lumber prices has exhibited the same pattern relative to the “all commodities” PPI. While lumber prices were 19.7% more volatile over the 1947-2020 period, they have been 100.1% more volatile than the broader index since January 2020.

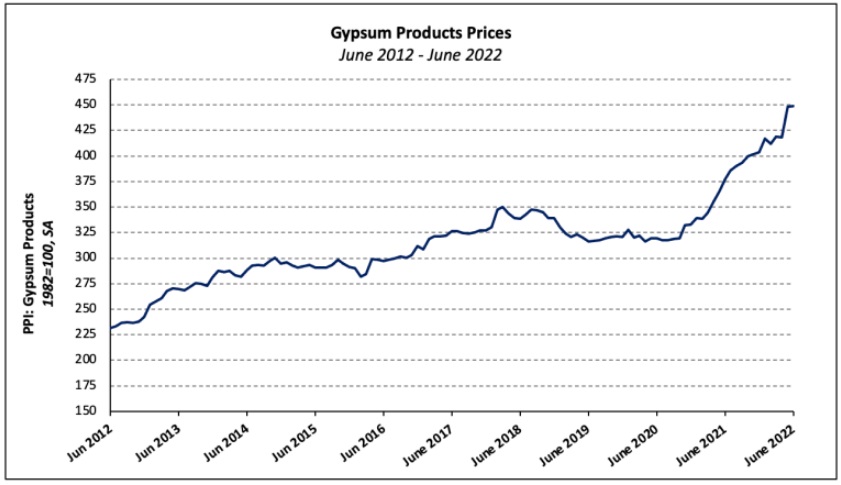

Gypsum Products

The PPI for gypsum products increased 0.1% in June after surging 7.1% in May. and has soared 22.6% over the past year. After a quiet 2020, the price of gypsum products climbed 23.0% in 2021 and is up 7.6% through the first half of 2022.

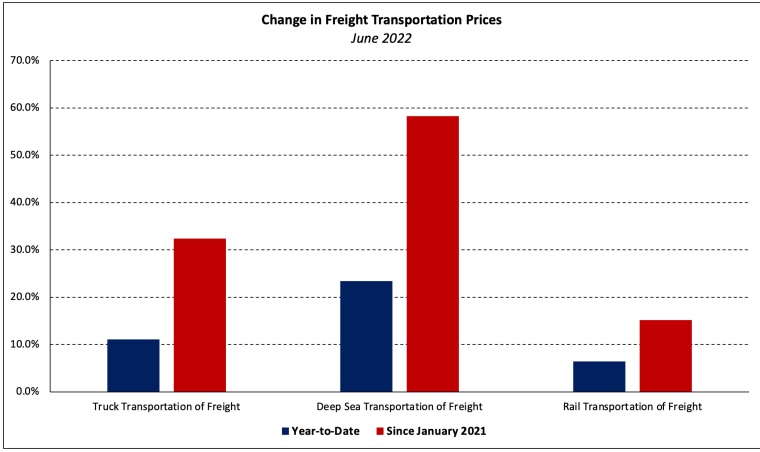

Transportation of Freight

The price of truck transportation of freight decreased 0.4% in June, the first monthly decline since May 2020. Since then, the indices for local and long-distance motor carrying prices are up 31.0%% and 46.5%, respectively.

Water transportation costs declined 1.5% in June after increasing 21.6% over the prior two months. Deep sea (i.e., ocean) transportation of freight prices—which are 27.2% higher than they were in March—have accounted for most of the three-month increase as the category accounts for over half of the water transportation PPI. The price of deep sea water freight has climbed 57.8% since the spring of 2020.

Not only have freight costs increased, but the prices of services to arrange freight logistics have climbed steeply as well. Over the course of 2021, the PPI for the arrangement of freight and cargo increased 95.1%. Although prices have fallen nearly 12%, YTD, they remain 57.5% above pre-pandemic levels.

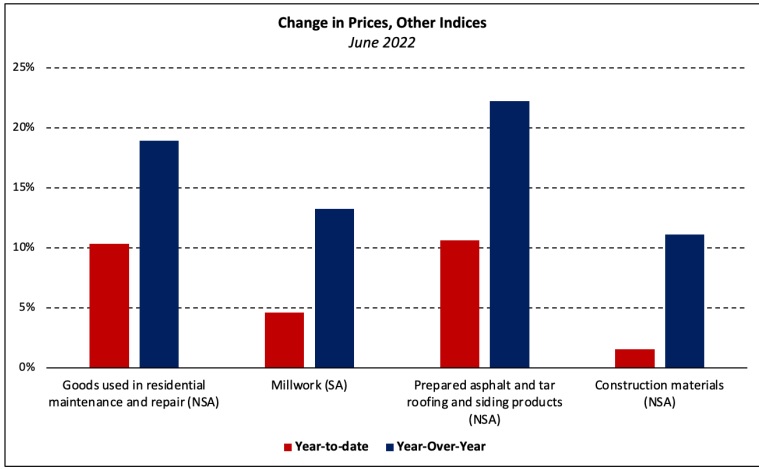

Other Building Materials

The chart below shows the 12-month and year-to-date price changes of other price indices relevant to the residential construction industry.